Ok Forex Markets

Trade online with our Brokers partner and use our trading services!

The advantages of a real ECN account

By opening an account with our broker partner you will have a real ECN account. It operates in a True ECN environment, no riquotation, no price manipulation and no restrictions. The ECN account is ideal for the traders, scalpers and robots who operate with great volumes.

-

Forex, Metals, Indices and Stocks

-

ECN Spreads

-

Segregated funds

-

Instant execution

-

Instant withdrawals

-

5-star customer support

-

NO Dealing Desk

-

Regulated Broker

OPEN A TRADING ACCOUNT NOW

Trade with more than 40 products, take advantage of leverage options up to 500:1, access the account from all desktop and mobilke devices, trade with scalping strategies and robots, with a segregated account and ECN spreads.

your ID documents.

and start trading.

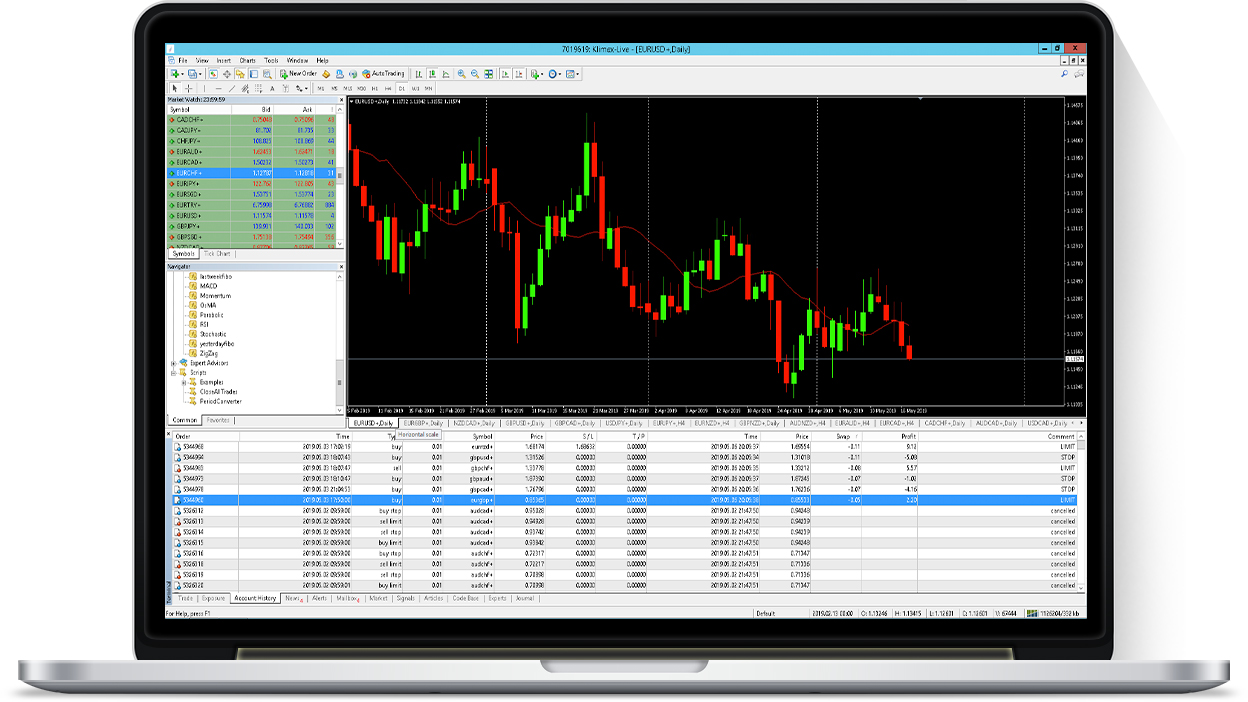

MT4: the Flawless Trading Platform

By opening a trading account you will be able to operate on the multi awarded platform MetaTrader 4. The most popular trading platform in the world for the forex traders thanks to its ease of use, the environment rich of functions and the possibility to do automatic trading.

Windows

Windows MacOS X

MacOS X iOS

iOS Android

Android

- Simple graphics

- Numerous analysis tools

- Customisable with indicators

- Programmable with mql4 language

- Useful for back tests

- Several time-frames

- Linear, candle or bar graphs

- Customisable colours and background

- Real time quotations

- Expert Advisor for automatic trading

A free Auto Trading system

Open a trading account, deposit at least 1000 euros and request our Auto Trading system. A Forex Robot for the MT4 which operates automatically, combines several styles of trading to reduce the risk and generate an annual profit. All this totally automatically!

The aim of Forex Pip Shooter is to combine several styles of trading to reduce the risk and generate an annual profit. It operates with the following currencies: AUD, CAD, CHF, EUR, GBP, JPY, NZD, USD. Their combinations generate 28 currency pairs.

Working on the resistance and support levels of these currency exchanges, thanks to breakouts, inversions e correlations, the lowest possible spread is necessary since the levels of the entry price are very accurate and a high spread could miss them or generate lower profits for every single operation.

Forex Pip Shooter is completely automatic, programmed to conduct a very advanced analysis by itself, exploiting the innovative Pip Shooter technology and available for 1 live (real) account or 1 demo account. For more information click here.

Special: Forex VPS & MT4 Tools

Opening a trading account you are entitled to a 30% discount on the fee of a Forex VPS with our partner leader of the sector which provides quality technology and security. Moreover, you will have the possibility to develop Expert Advisor for MT4 at a discounted price.

Forex VPS

Opening a trading account, without considering the number of traded lots and/or the volume, you are entitled to a 30% discount on the monthly fee of a Forex VPS with our partner.

- Caratteristiche Forex VPS:

- 3 vCore

- 2 GB Ram

- 30 GB HD o SSD

- Windows Server 2012 r2

- Dedicated IP

- Remote Desktop Access

- Web Control Panel

- MetaTrader 4 Support

- MetaTrader 4

- Any EA

- Support in English

With Ok Forex Markets I will pay the Forex VPS only:

Development MT4 Tools

Opening a trading account you can request the development of tools for MT4 at a discounted price such as:

Indicators. The indicators are purely visual objects for manual trading. They attach to the current graph or in a separate window..

Expert Advisor (EA). The Experts Advisors (EA) are programmes which allow the Metatrader to enter the market in autonomy. They attach to the current graph but they can be opened also on more than one graph at the same time. Your strategy can be automatised, and after a thorough analysis you will be able to drastically reduce your time in front of the screen.

Script. The Scripts are programmes which allow the MT4 to enter the market in autonomy. Differently from the EAs, they execute the commands of One Shot, therefore only once. They attach to the current graph. They are used to drastically speed up your operations in the market, as a necessity during the macro data or adding very quickly Stop and Target to the existing operations.

Find out moreTrade with more than 40 products, take advantage of leverage options up to 500:1, access the account from all desktop and mobilke devices, trade with scalping strategies and robots and with a segregated account.